What is the full form of PAN

PAN: Permanent Account Number

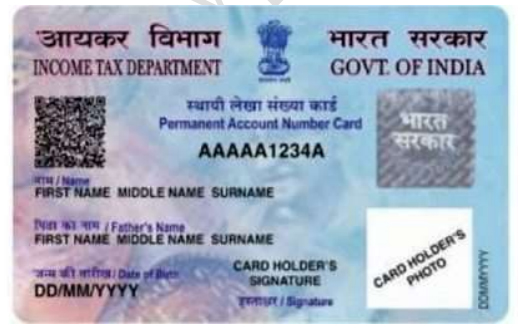

PAN stands for Permanent Account Number. Permanent Account Number (PAN) is a ten-digit alphanumeric number allotted by Income Tax Department in the form of a laminated card.

A PAN is a unique identifier issued to all judicial entities identifiable under the Indian Income Tax Act, 1961.

Nowadays, it is mandatory to link the PAN card with the bank account numbers.

The alphanumeric characters of PAN card is issued in this format – AAAAA1234a.

Out of the first five characters, the first three characters represent the alphabetic series running

from AAA to ZZZ.

The fourth character of PAN represents the status of the PAN holder.

- “P” stands for Individual

- “C” stands for Company

- “H” stands for Hindu Undivided Family (HUF)

- “A” stands for Association of Persons (AOP)

- “B” stands for Body of Individuals (BOI)

“G” stands for Government Agency - “J” stands for Artificial Juridical Person

- “L” stands for Local Authority

- “F” stands for Firm/ Limited Liability Partnership

- “T” stands for Trust

Fifth character of PAN represents the first character of the PAN holder’s last name/surname in case of an individual. In case of non-individual PAN holders fifth character represents the first character of PAN holder’s name.

Next four characters are sequential numbers running from 0001 to 9999.

Last character, i.e., the tenth character is an alphabetic check digit.

Utility of PAN

PAN enables the department to identify/ link all transactions of the PAN holder with the department. These transactions include tax payments, TDS/TCS credits, returns of income, specified transactions, correspondence etc, and so on. It facilitates easy retrieval of information of PAN holder and matching of various investments, borrowings and other business activities of PAN holder.